Objective: Apply GenAI to Enhance User Experience with Accurate Benefits Information

Client: A Leading Insurance Provider

Industry: Healthcare Insurance

In the dynamic world of healthcare insurance, our client, a prominent insurance provider, faced a significant challenge: efficiently addressing user inquiries regarding benefits coverage. Subscribers frequently asked questions like, “Is my second chiropractor visit covered under my plan?” The lack of quick, accurate responses was a major pain point, impacting customer satisfaction and operational efficiency.

Gen AI Solution: Leveraging Advanced Technology

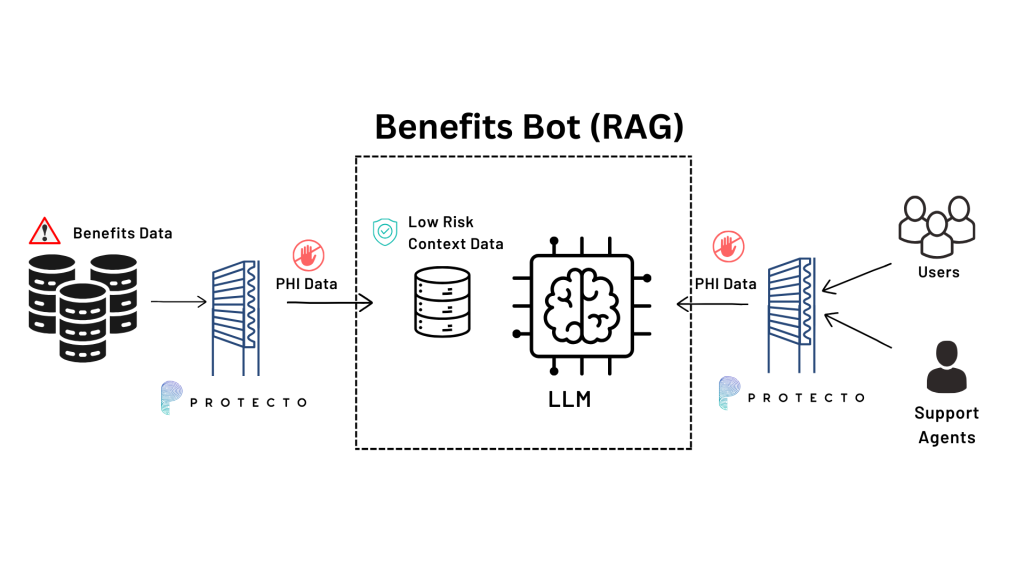

To tackle this issue, the insurance provider implemented a groundbreaking solution using a generative AI-based Retrieval-Augmented Generation (RAG) system. This system, powered by Large Language Models (LLM), was designed to automate and aid in responding to user queries about benefits coverage. The AI’s ability to understand and process natural language queries significantly enhanced the speed and accuracy of the responses provided to users.

Benefits of the Gen AI Solution

- Improved User Experience: Subscribers received faster and more accurate answers to their queries, leading to increased satisfaction.

- Operational Efficiency: The automated system reduced the workload on customer service representatives, allowing them to focus on more complex tasks.

- Scalability: The AI solution could easily handle a growing number of inquiries without additional resource allocation.

Challenges: Privacy, Security Risks, and Compliance Hurdles

However, implementing this AI solution brought forth significant challenges, particularly in handling Personal Health Information (PHI), which is subject to stringent HIPAA regulations. The accuracy of the AI system depended heavily on access to real user data, but using PHI raised serious privacy and security concerns. Stripping the data of PHI to comply with regulations led to a noticeable drop in the accuracy of the AI responses.

Addressing data privacy and compliance requirements is essential for the project to advance from the Proof of Concept (POC) stage to full-scale production.

The Protecto Solution: Intelligent Tokenization as a Key

This is where Protecto, our enterprise B2B data protection SaaS company, stepped in. We provided an innovative solution that balanced the need for data accuracy with the imperative of maintaining privacy and security.

Protecto’s Masking Technique:

- Data Masking: Protecto implemented a sophisticated pseudonymization technique that identified sensitive identifiable PHI data and replaced it with artificial identifiers (tokens) or pseudonyms.

- Format-Preserving Masking: Crucially, Protecto maintained the format of the original PHI data. This ensured that the AI model could recognize and process the underlying entities accurately, leading to precise and relevant responses.

- Maintaining Data Integrity: Most masking tools and techniques can’t maintain data integrity leading to loss of data utility and accuracy. Protecto’s intelligent tokenization process ensured that the data remained useful and accurate for the AI system without compromising individual privacy.

- Compliance with HIPAA: By pseudonymizing PHI, we ensured that our client’s solution was fully compliant with HIPAA regulations, mitigating legal and reputational risks.

Results: Enhanced Accuracy with Reduced PII Exposure

The implementation of pseudonymization by Protecto led to a significant reduction in PII exposure, effectively addressing the privacy and security concerns:

- High Accuracy Maintained: The AI system continued to provide highly accurate responses, as the integrity of the data was preserved.

- Compliance Achieved: The solution met all regulatory requirements, providing peace of mind to our client and their subscribers.

- Trust and Reliability: Subscribers could trust that their personal information was secure, bolstering their confidence in the insurance provider.

Conclusion

By partnering with Protecto, the insurance provider successfully overcame the challenges of integrating advanced AI technology into their customer service operations while adhering to strict data protection regulations. This case study demonstrates Protecto’s commitment to delivering innovative data protection solutions that do not compromise on efficiency or compliance, paving the way for a new era in secure, AI-powered customer service in the healthcare insurance industry.